Joyce Morgan

Duval County Property Appraiser

Welcome!

Welcome to the Duval County Property Appraiser’s website. Our staff is dedicated to providing you, the public, with the information you need to understand our role in determining your property values. We are here to assist you with commercial, residential, tangible personal property and exemption questions. On this site you can access detailed information using both our real estate property search and tangible property search as well as forms, exemption information and much, much more. Please scroll over to the menu options tab on the far top left of your screen to view all additional categories of available topics.

The Duval Clerk and Duval County Property Appraiser's offices announces that the Clerk's office has launched a Property Fraud Alert system to help citizens maintain the security of their property. This service allows participants to monitor a personal or business name and be notified whenever a document is recorded in Duval County under that name. Best of all, this program is entirely free of charge.

According to the FBI, property fraud is the fastest growing white-collar crime committed in the United States. Scammers file fake deeds, making it appear as if they own homes that are not actually theirs. These criminals then trick people into giving them money to rent or buy those homes.

The Fraud Alert seeks to help put a stop to these criminal acts. If a document is recorded that matches your monitoring criteria, you will receive an alert within 48 hours so that you can review the document to make sure it is legitimate. "We are happy to be able to promote the link for signing up on our website to help our taxpayers combat criminals who desire to falsely take possession of their property."

For full details and to sign up for the Property Fraud Alert, please visit: duvalclerk.gov/services/property-fraud-alert.

Attention: Real Estate Buyers and Sellers

The aerial imagery available from our website does not always reflect the actual boundaries and should never be relied upon when purchasing property. When conducting real estate transactions, we would encourage you to obtain the services of a licensed surveyor for property boundaries and contract with a title company before purchasing any property.

Florida law requires the Property Appraiser’s Office to inspect all property in the county at least once every five (5) years. We do not inspect the interior of residential properties. For your safety, all our employees drive clearly marked vehicles, wear blue collar shirts with our seal, and carry City of Jacksonville identification.

If you would like to report suspected exemption fraud,

please call our exemption fraud hotline at (904)255-7964

Click this link to request our office to attend or speak at an event.

Your 2025 Truth in Millage Annual Newsletter and additional millage information are now available for download.

Download 2025 Truth in Millage Annual Newsletter

Download A Florida Homeowner’s Guide: Millage

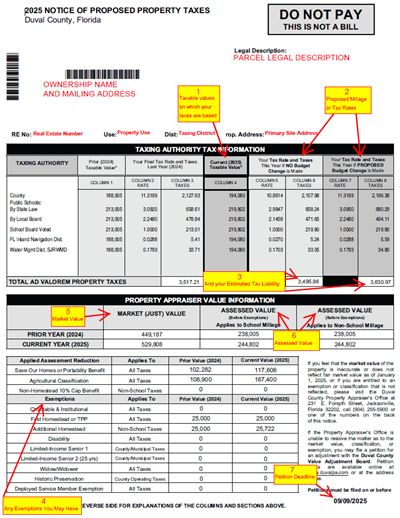

Understanding your Notice of Proposed of Taxes

Truth in Millage Property Records Cards (TRIM PRCs) for Real Estate Value Adjustment Appeal Available Online

Attention Petitioners/Owners of Real Estate Property: If you request a Property Record Card on your Petition to the Value Adjustment Board (DR 486), the PRCs are now provided by the Property Appraiser’s Office online via the Property Search. They are no longer mailed by the VAB (per FL Statute 194.032(2)(a)). Starting Friday, August 15th, 2025, to access your Real Estate PRC, pull up your property record via the Property Search, then scroll down and click on 2024 TRIM Property Record Card (just below the 2024 Notice of Proposed Property Taxes section). If you cannot access or print the PRC, you may call the Property Appraiser's Office at 904-255-5900

Filing for a Homestead Exemption

Filing for a Homestead Exemption

File Online for a 2026 Homestead Exemption Those who own and moved into a new home in Duval County after January 1, 2025, may now file for a 2026 homestead exemption using the homestead exemption online application.

To be eligible for a homestead exemption, the property must be your permanent home or the permanent home of a person who is legally or naturally dependent on you on January 1 of the tax roll year for which you are applying. The online application will walk you through the filing process and can be submitted over the web.

You may also file by completing the manual Homestead Exemption application. You may submit the manual application with other required documentation to the Customer Service/Exemptions Division at 231 E. Forsyth Street, Suite 260, Jacksonville, Florida 32202, fax it to (904) 255-7963, or e-mail it to pacustserv@coj.net.

The deadline to file timely for the 2026 Tax Roll is March 1, 2026. Late filing is permitted through early September. (The deadline for late filing is set by Florida law and falls on the 25th day following the mailing of the Notices of Proposed Property Taxes which occurs in mid-August.)

If you established a new homestead and had a previous homestead exemption on another home in Florida, you may be eligible for Portability – the transfer of some or all of your previous homestead’s “Save Our Homes” benefit (the difference between your market and assessed values due to the annual cap on increases).

When filing online, some special circumstances may require that additional documentation be mailed to the Property Appraiser’s Office. In these cases, users will be prompted with necessary forms or a list of needed documents at the end of the process.

If you need further assistance, please contact our Customer Service/Exemptions Division staff at 904-255-5900.

2025 Tax Roll

The 2025 Final Tax Roll was Certified on October 13, 2025

The 2025 Preliminary Tax Roll was approved on June 30, 2025

The 2024 Post VAB Tax Roll was Recertified on July 2, 2025

2025 Millages, Levies & Distributions:

Notices of Proposed Property Taxes

The 2025 Notices of Proposed Property Taxes, also called the "Truth in Millage" (TRIM) Notices, are mailed to property owners on Friday, August 15th, 2025. The formal deadline to file a petition with the Value Adjustment Board (VAB), printed on the TRIM Notice, is Tuesday, September 9th, 2025.

If you initiate an informal review of your property's value with the Property Appraiser's Office, your patience is appreciated. Appraisers will process review requests, and notify property owners of the outcome of informal reviews. Your property tax record is available online. Once TRIMs are mailed you can access your property’s current TRIM information online too. Please use our Property Search or Tangible Search to retrieve information for your specific property.

For more information relating to the Value Adjustment Board, visit the VAB’s web site or call (904) 255-5124. Important Note: Property owners who filed petitions with the VAB are required to partially pay ad valorem taxes (75% in most cases) and pay all of the non-ad valorem taxes before the delinquency date (usually April 1) to avoid denial of their petition. Contact the VAB for more information.

2025 Property tax bills will be mailed by the Tax Collector on or about November 1, 2025. If you have questions about how to pay your bill please go to http://www.coj.net/Departments/Tax-Collector.aspx or email at taxcollector@coj.net.

Public Records Exemption

Apply for Public Records Exemption

Authorize Release and Removal of Information Exempt from Public Records

Protected Addresses Info Pamphlet

Aerial Photography

.aspx)

Annual Report on 2024 Tax Roll

Get details on Duval County property values, tax levies and more in the Annual Report on the 2024 Tax Roll.

The report contains historical data in addition to information specific to the 2024 Tax Roll.

(270MB .pdf - Requires Adobe 6.0 Acrobat Reader or higher.)

PAO Annual Budget Information Available

View the FY 25 Budget for the Duval County Property Appraiser's Office (per 195.087(6), Florida Statutes)

View the FY 26 Budget for the Duval County Property Appraiser's Office (per 195.087(6), Florida Statutes)

Have Questions and Need Answers?

Questions regarding ownership, exemptions or assessments should be directed to the Office of the Property Appraiser at (904) 255-5900 or pacustserv@coj.net.

For questions relating to billing and payment of taxes, contact the Office of the Tax Collector at (904) 255-5700 or www.coj.net/tc or email taxcollector@coj.net.

Property Owner Bill of Rights

(FS 70.002)

This Bill of Rights does not represent all of your rights under Florida law regarding your property and should not be viewed as a comprehensive guide to property rights. This document does not create a civil cause of action and neither expands nor limits any rights or remedies provided under any other law. This document does not replace the need to seek legal advice in matters relating to property law. Laws relating to your rights are found in the State Constitution, Florida Statutes, local ordinances, and court decisions. Your rights and protections include:

1. The right to acquire, possess, and protect your property.

2. The right to use and enjoy your property.

3. The right to exclude others from your property.

4. The right to dispose of your property.

5. The right to due process.

6. The right to just compensation for your property taken for a public purpose.

7. The right to relief, or payment of compensation, when a new law, rule, regulation, or ordinance of the

state or a political entity unfairly affects your property.

Legal Resources

LEARN ABOUT HEIRS PROPERTY WITH LISC USING THE LINK BELOW.

https://www.lisc.org/our-initiatives/affordable-housing/heirs-property/

.png.aspx)

FAMILY HOME WITH DECEASED OWNER

APPLY FOR THE CITY OF JACKSONVILLE’S HEIR PROPERTY RESOLUTION PROJECT USING THIS LINK

RECEIVE FREE LEGAL HELP FROM JACKSONVILLE AREA LEGAL AID. INC. (JALA)

If the person named on the deed to your family property is dead, you need a probate court to transfer ownership of that real property to the heirs of the deceased owner (either with or without a Last Will). Any heir living in the home cannot receive the homestead exemption until a court order adds his or her name as an owner.

If you have comments about this website which would help us better serve you in the future, please e-mail us at: PAAdmin@coj.net.

*** Under Florida law, e-mail addresses are public records. If you do not want your e-mail address released in response to a public records request, do not send electronic mail to this entity. Instead, contact this office by phone or in writing. ***

Tourist Tax

1. Short-term transient rentals must remit additional sales & use tax to the Duval County Tax Collector's Office monthly. Please e-mail TouristTax@coj.net for more information.

2. AirBNB, VRBO, and other transient-rental hosting websites DO NOT remit taxes directly to Duval County for any users.

The property owner MUST remit these taxes directly. Please e-mail TouristTax@coj.net for more information.

3. E-mail TouristTax@coj.net for information regarding mandatory monthly tax collection and remittance for short-term transient rentals with the Duval County Tax Collector's Office.

4. Short-term rentals contain personal property that is subject to property tax, known as Tangible Personal Property (TPP). While household goods are excluded from the definition of TPP under Florida Statute 192.001, household goods are defined as furniture, appliances, and other items ordinarily found in the home and used for the comfort of the owner. However, when a home is used as a rental—whether short-term or long-term—these items are considered TPP.

Anyone who owns TPP on January 1 must file a Tangible Personal Property Return with the Property Appraiser by April 1 each year. More information on filing can be found at:

https://www.jacksonville.gov/departments/property-appraiser/tangible-personal-property